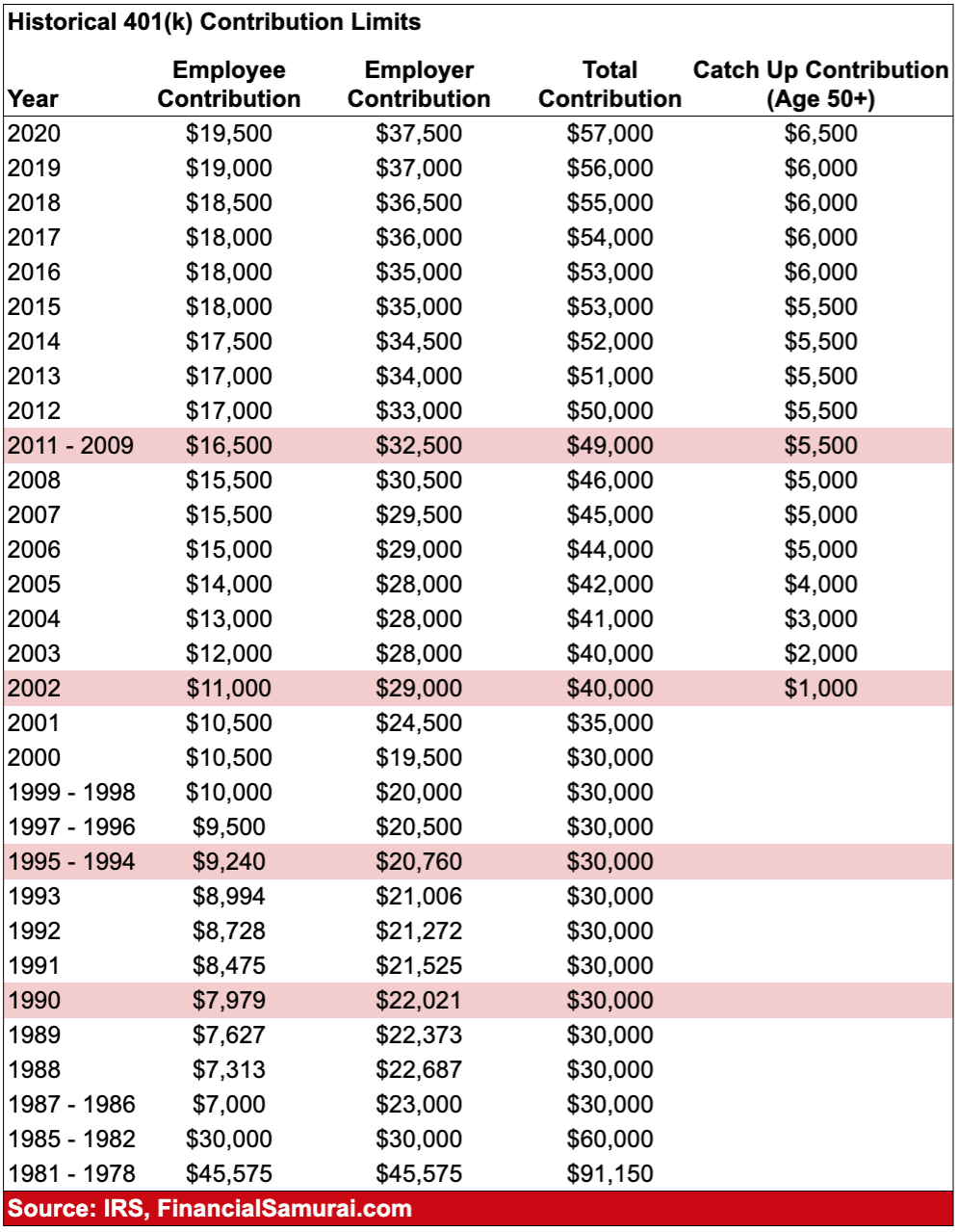

401k Contribution Limits 2025 50 And Older. The maximum amount you can contribute to a roth 401(k) for 2025 is $23,000 if you're younger than age 50. You just can't exceed the retirement plan contribution limits set by the irs.

2025 401k Limits Chart Over 50 Grata Karlene, The 401(k) contribution limit for 2025 is $23,000, or $30,500 if you’re at least 50.

What Is The Maximum 401k Contribution 2025 Over 50 Ray Mareah, Employees age 50 and older are subject to a higher contribution limit with either type of contribution.

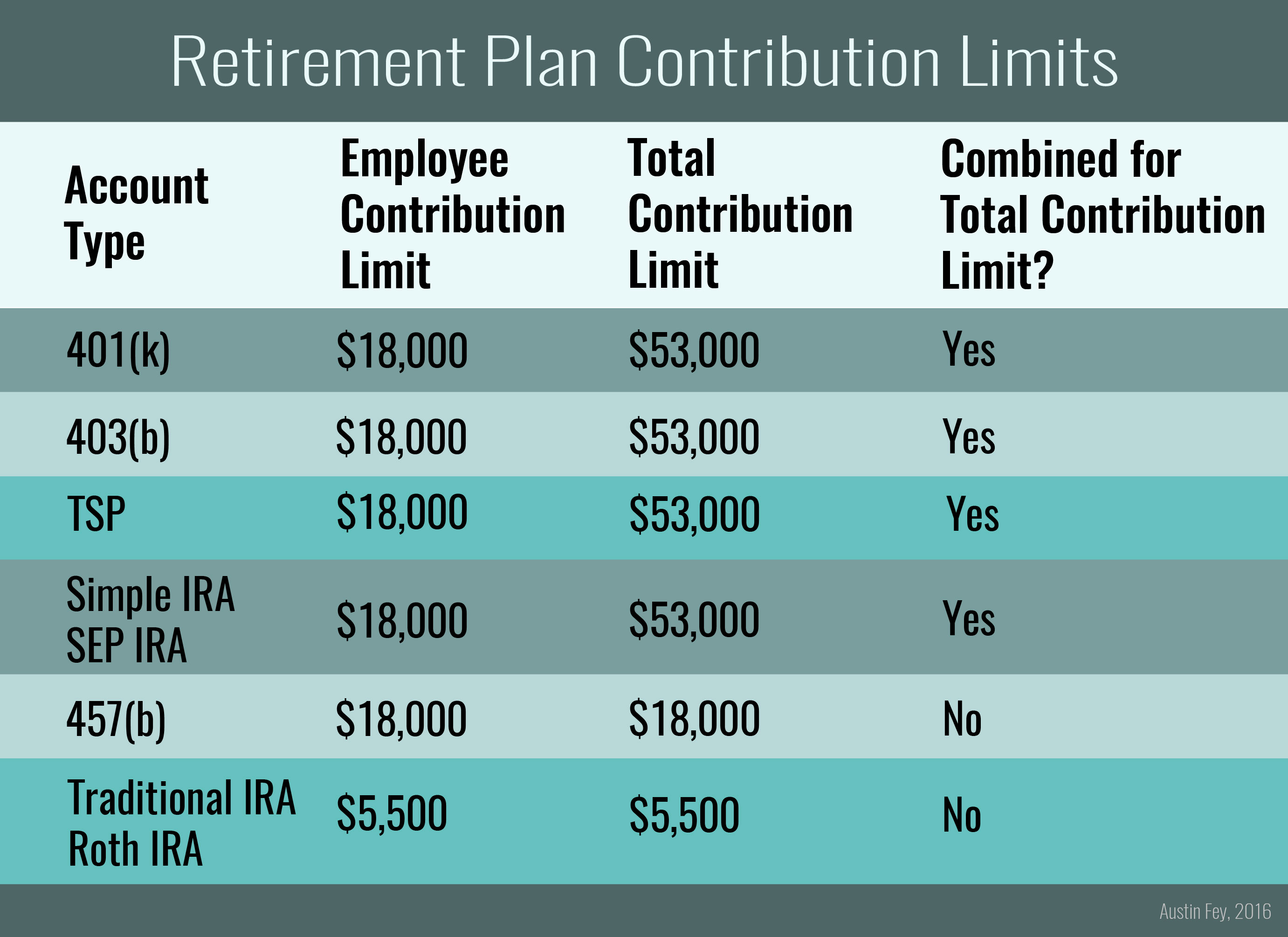

401k Contribution Limits And Limits (Annual Guide), The same applies to 457(b) plan deferrals of $23,000.

2025 401k Catch Up Contribution Limits 2025 Over 55 Kass Sarene, Contributions to a traditional ira ($7,000, or $8,000 for those age 50 or older in 2025) do not count toward the limits above.

401k Limits For 2025 Over Age 50 Elayne Evangeline, Those 50 and older can contribute an additional.

401k Limits For 2025 Over Age 50 Goldy Karissa, The same applies to 457(b) plan deferrals of $23,000.

401k Max Contribution 2025 Calculator Over 50 Kiley Merlina, In 2025, aggregate contributions can reach up to $69,000 if you are under 50 and $76,500 if you are 50 or older.

401k Contribution Limits 2025 Over 50 Years Abbi Linell, (for 2025, those annual limits were $23,000 for a 401(k) and an additional $7,500 for those 50 and older.)