2025 Tax Brackets Single Senior. Your average tax rate is. Learn about the applicable tax brackets, exemptions, and deductions to.

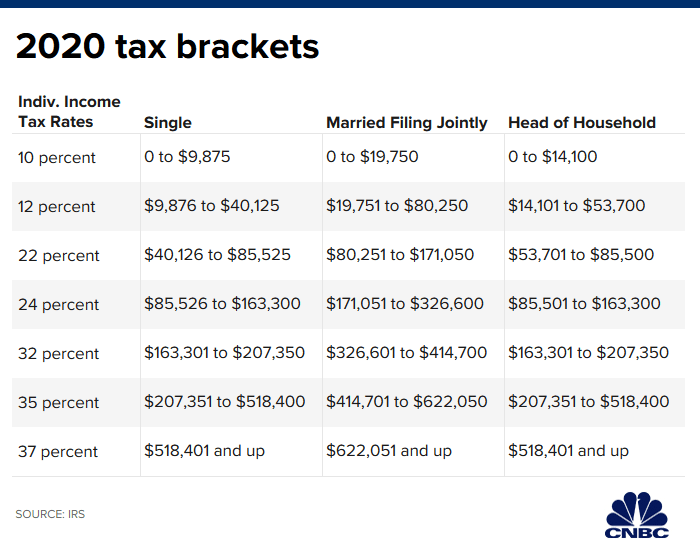

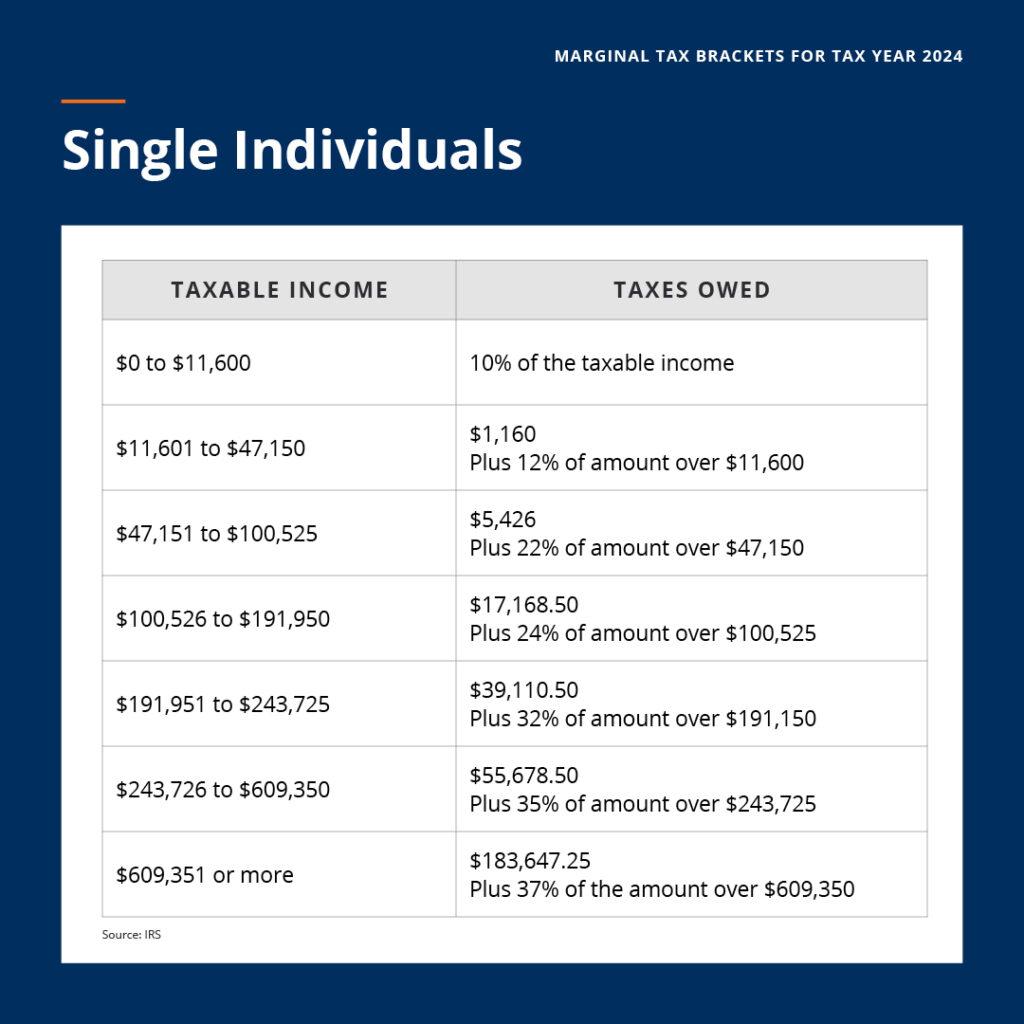

Learn about the applicable tax brackets, exemptions, and deductions to. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

2025 Tax Brackets Single Senior Dareen Oneida, The income tax exemption limit is up to ₹3 lakh for senior citizens aged 60 to less than 80 years.

Tax Brackets 2025 Explained For Seniors Eva Jemimah, Per comprehensive tax reform enacted in 2025, iowa is phasing in a single rate of 3.9 percent by 2026.

2025 Tax Rates For A Single Taxpayer Paige Jessamine, This article focuses on the tax slab rates, surcharges, and exemptions for individual taxpayers, senior citizens, super senior citizens, the association of persons.

2025 Tax Brackets For Seniors Over 65 Clary Devinne, Surcharge and cess are applicable as per rules.

2025 Tax Brackets Single Irs Mamie Rozanna, Up to ₹2,50,000 for individuals, huf below 60 years aged and nris.

Tax Brackets 2025 Irs Single Barb Marice, With the new tax regime slabs, certain changes have come about for the income.

2025 Tax Brackets For Seniors Over 65 Single Lonni Randene, You can use our federal tax brackets calculator to determine how much tax you will pay for the current tax year, or to determine how much tax you have paid in previous tax.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, Learn about the applicable tax brackets, exemptions, and deductions to.

2025 Tax Brackets And Standard Deduction Table Cate Marysa, If you make $70,000 a year living in maine you will be taxed $10,992.